DJI Is Pulling Away from Rivals in the Video Camera Market

![]()

A new report from Japanese retail analysts BCN Retail (BCN+R) shows that DJI dominates Japan’s video camera market.

BCN+R’s report shows that from November 2023 through last month, DJI’s Osmo Pocket 3 owns a shocking 24.3% of the Japanese video camera market. While BCN+R’s data is not comprehensive, it represents a significant portion of the country’s retailers.

What makes the Osmo Pocket 3’s performance especially impressive is that it leads the second-place camera, the GoPro Hero 12 Black, by 15.2 percentage points, outpacing the Hero 12 Black by a ratio of nearly 2.7:1.

The Osmo Pocket 3, announced in October 2023, has proven popular with consumers since its release thanks in large part to its bigger Type 1.0 CMOS image sensor, 4K/120p recording, HDR recording, and compact form factor. In PetaPixel‘s DJI Osmo Pocket 3 Review, David Schloss writes, “If you are a solo creator looking for a great solution in an image-stabilized do-anything,-go-anywhere package, then DJI Osmo Pocket 3 is the right choice.”

The DJI Osmo Action 4, Osmo Action 3, and Pocket 2 all make the BCN Rankings’ top 10 list, too.

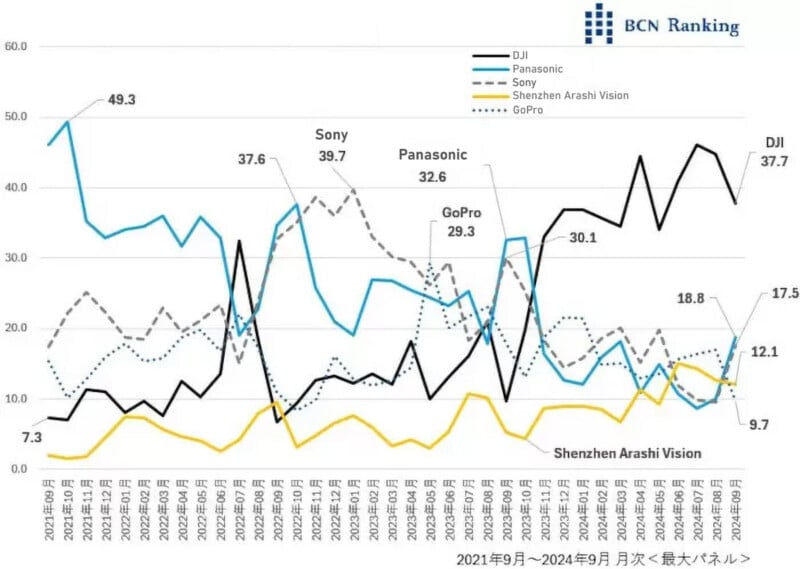

Due to the Osmo Pocket 3’s popularity, DJI has been the leading manufacturer of video camera sales for 11 consecutive months. However, as BCN+R demonstrates, DJI’s strong performance goes far beyond the past year or so. In the three years from September 2021 to September 2024, DJI’s video camera market share has exploded from 7.3% to 37.7%.

This meteoric rise comes at the cost of market share for everyone else. When DJI held just 7.3% of the market, Panasonic held nearly half (49.3%). Panasonic’s share has fallen to 12.1% in the three years since, up slightly from its lowest point earlier this year at just under 10%.

While DJI has mostly trended upward in the past three years and Panasonic has generally experienced the opposite, Sony has been all over the place. In late 2022, Sony peaked at 39.7% market share before dipping to 17.5%, which is extremely close to where Sony was in September 2021. It is also worth noting that the yellow bar on the chart above, Shenzen Arashi Vision, is Insta360. For the first time, Insta360 passed GoPro in the past couple of months.

It is vital to note that while Panasonic and Sony are being bested in the BCN+R data here, the companies are partially cannibalizing themselves. The data is for video cameras. This means hybrid cameras, of which Panasonic and Sony make many popular models like the Panasonic S5IIX and the Sony ZV-E10, to name just two, are not included in the data and are partially to blame for the dramatically changing video camera market.

As BCN+R observes, traditional video cameras are victimized by numerous trends. Beyond the most obvious one, the rise of smartphone popularity, the hybridization of interchangeable lens cameras is also killing so-called “normal” video cameras and camcorders. Part of why DJI is doing so well in the video camera space is because it does something different from traditional manufacturers and smartphones. Gimbal-stabilized products like the Osmo Pocket 3 and compact action cameras such as the Osmo Action 4 offer consumers something unique that smartphones and typical video cameras cannot.

As the stalwarts of the video camera space change up their approach, focusing less on video-only cameras and more on hybrid offerings, a vacuum has opened up, and relatively new players like DJI, GoPro, and Insta360 have swooped in to fill it.

Image credits: Featured image by DJI with an asset licensed via Depositphotos.