Olympus Continues Freefall: Rumors of ‘Underworld Links’ and FBI Involvement

More news from the ongoing Olympus scandal: despite an official explanation …

More news from the ongoing Olympus scandal: despite an official explanation …

Update: Olympus has released an official response to the allegations.

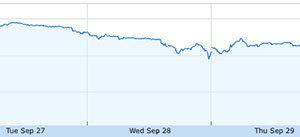

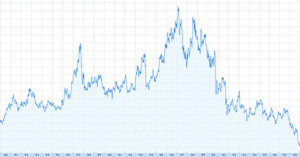

Since Olympus abruptly fired CEO Michael Woodford (pictured, on left) four days ago, the company's stock price has fallen from roughly ¥2,480 to its current price of ¥1,417, a 43% drop that wiped out nearly $4 billion in value. As we reported yesterday, Woodford is now asking the UK to investigate the company's financial practices, and is claiming that he was booted when on the verge of exposing fraud.

Here’s a strange (and extremely rare) piece of camera gear: the Leica Telephoto …

Olympus fired CEO and President Michael Woodford today, causing the company’s stock price to take a 17% dive. The …

Kodak’s stock plummeted again today, losing nearly 50% of its value and closing …

Yesterday Kodak’s stock fell 64 cents, or 26.9%, to close at $1.74 — the lowest the stock price has …

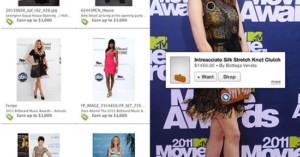

Microstock did a lot of damage by turning traditional stock photography on its head, but now a company called …

Japanese business newspaper Nikkei reported yesterday that Nikon is on the cusp of announcing its entry into the mirrorless …

If you look at the price of Kodak's stock, you'll see that the company is currently worth about $600 million -- a figure that may be significantly lower than what its digital imaging patents could sell for. With the risk looming that a buyer might try to acquire the patents by simply taking over the company, Kodak is taking evasive maneuvers.

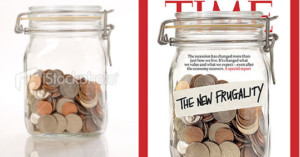

This card company must feel pretty good about itself — they managed to save 50% on the stock photos …

If Fujifilm has been waiting to see whether the retro-tastic FinePix X100 would sell well before working on an …

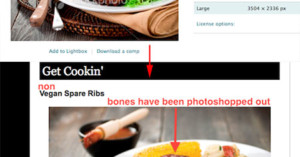

In the past week or two there has been an interesting controversy regarding the use of stock photography: vegan blogger quarrygirl.com published a post on April 13th accusing the nations leading vegan magazine VegNews of using non-vegan stock photos to illustrate its vegan recipes. An example presented is a "Vegan Spare Ribs" article that uses a Photoshopped iStockPhoto image of actual barbecue spare ribs (shown above).

Slate magazine just published an interesting article on David Hobby and his popular …

The stock prices of major camera equipment manufacturers took a major — and expected — dive after the earthquake …

This video by FotoTV features “microstock king” Yuri Arcurs leading a workshop and …

What you see here is the history of Kodak stock starting from 1978. In the mid-1990s the stock peaked …

Flickr has just announced a new feature that lets you to add a “Request …

Recent surveys found that many image users in the United States and UK …

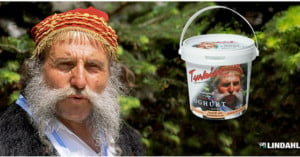

Athanasios Varzanakos, a Greek man, is suing Swedish dairy company Lindahls for using his image on containers of Turkish-style …

At CES 2010 next year, photography automation company Ortery will unveil the Photosimile 5000, a device that they claim is the "next generation imaging device for the office." Essentially it's like a copier, except for stock/product photography. You can simply walk up to the machine, place what you'd like to photograph inside, adjust a few settings on the parameter, and walk away with a professional looking product photograph. The computer-operated system automatically adjusts lighting to remove shadows, and takes care of handling white balance.