Nikon Sold a Lot of Cameras and Lenses But Still Lost Money

![]()

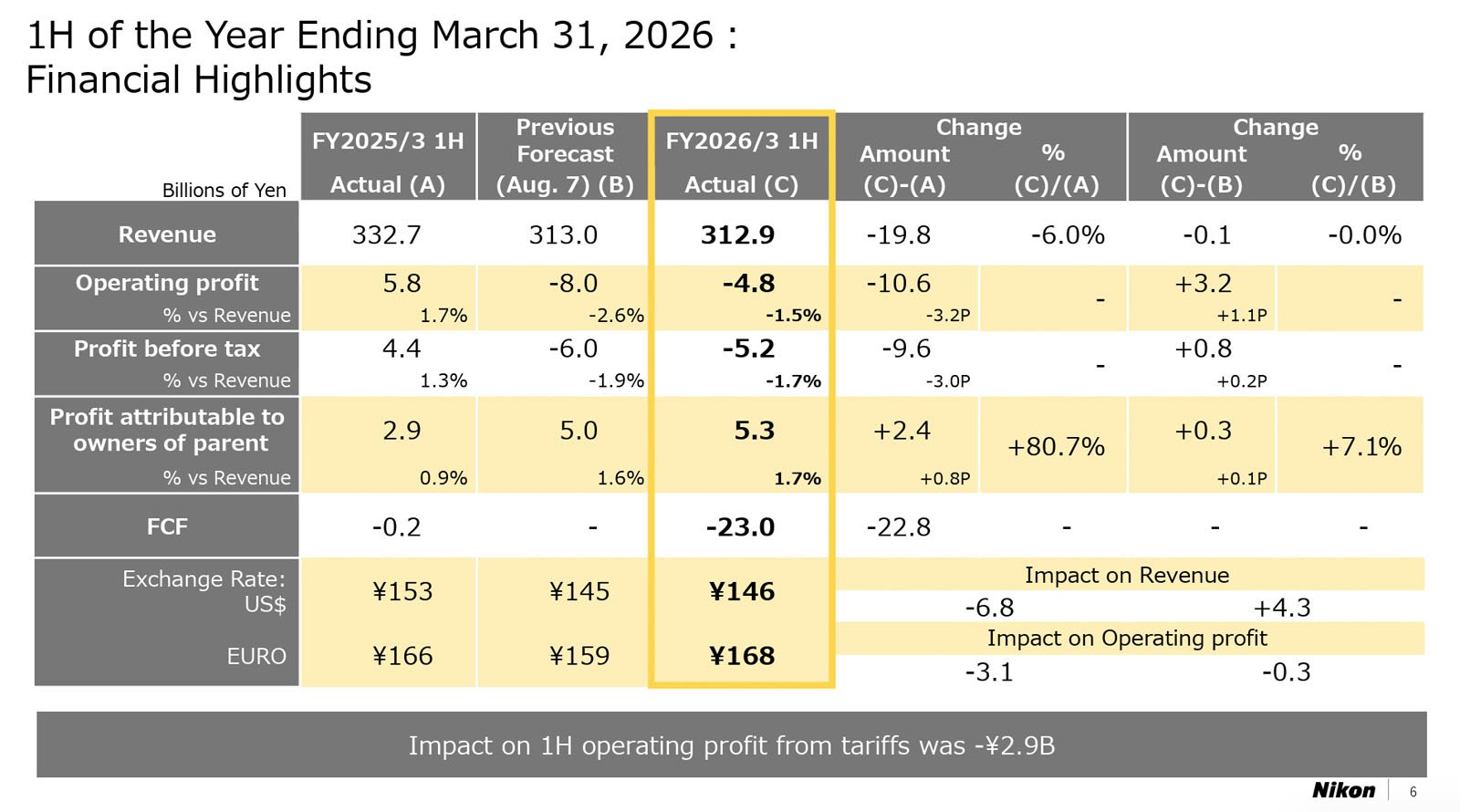

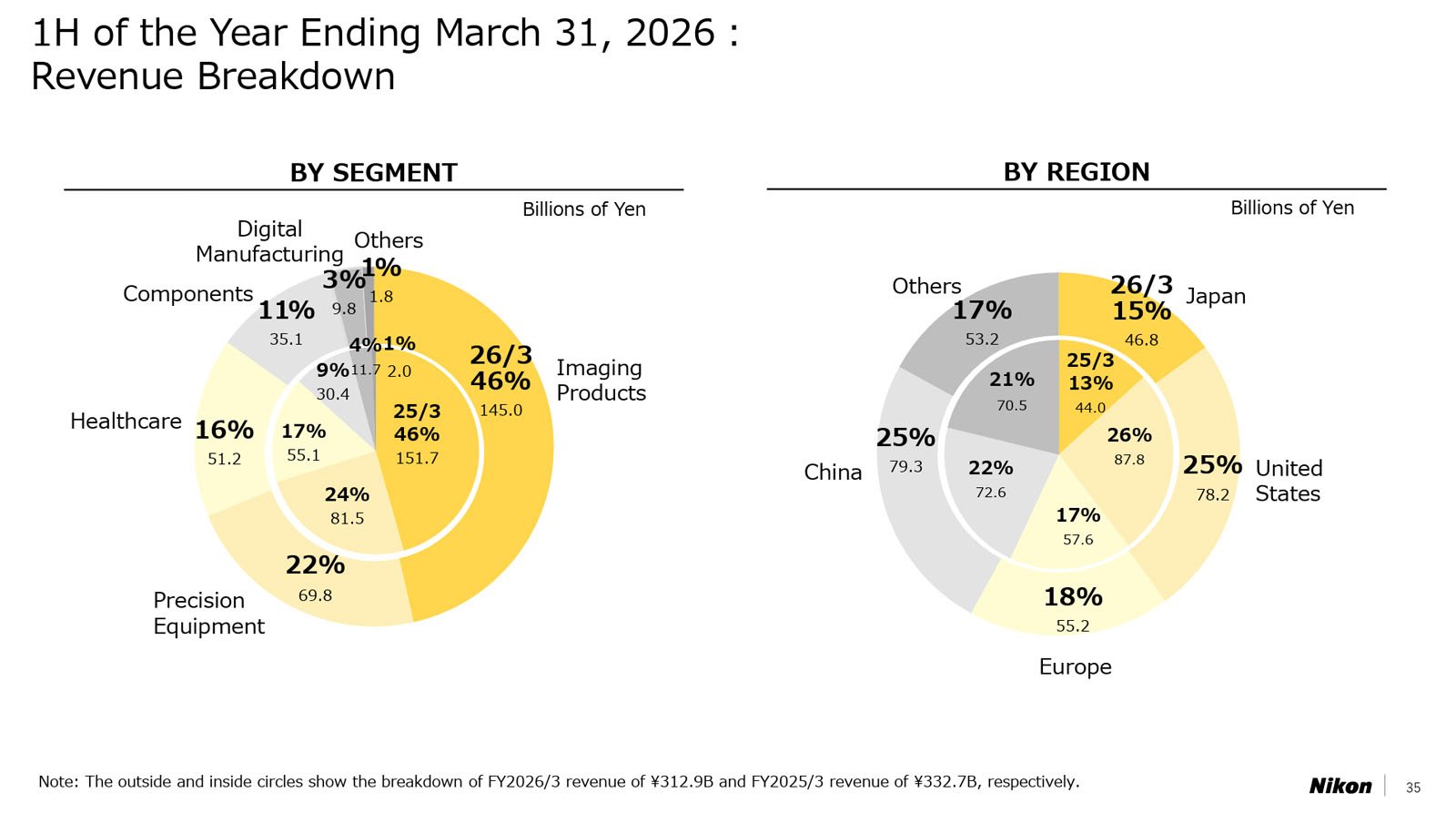

Nikon lost nearly 5 billion yen ($31.3 million) from April to September 2025, primarily because of U.S. tariff policy. It is the company’s first operating loss in the first half of a fiscal year in five years. However, the company’s imaging division remains strong.

Over the same period in 2024, April through September, Nikon posted a profit of 5.8 billion yen ($37.8 million), so it has been a tough start to FY2026 for Nikon at large. The fiscal year will end on March 31, 2026, so it will be fascinating to see how the company’s situation evolves in the latter half of its financial year.

Nikon explains in its financial results that operating profit was down 4.8 billion yen ($31.3 million), which is down 10.6 billion yen ($69.2 million) year over year. Overall revenue was down a whopping 19.8 billion yen ($129 million) year over year.

However, while this sounds bad — and is — Nikon’s fiscal year is actually doing better than the company feared in its last forecast on August 7, at the end of the first quarter. At that time, Nikon expected to lose even more money than it did, and outperformed its expectations by over 3 billion yen ($20.8 million).

There are many reasons for Nikon’s up-and-down performance, but among the most significant is tariffs. By the end of the fiscal year next March, Nikon expects the full tariff impact on its operations to be 7.5 billion yen ($48.9 million at current exchange rates). Although Trump’s controversial tariffs are currently under a microscope at the U.S. Supreme Court, and may very well be struck down, at least in part, tariffs continue to wreak havoc on companies in the U.S. and especially abroad. Nikon is no exception.

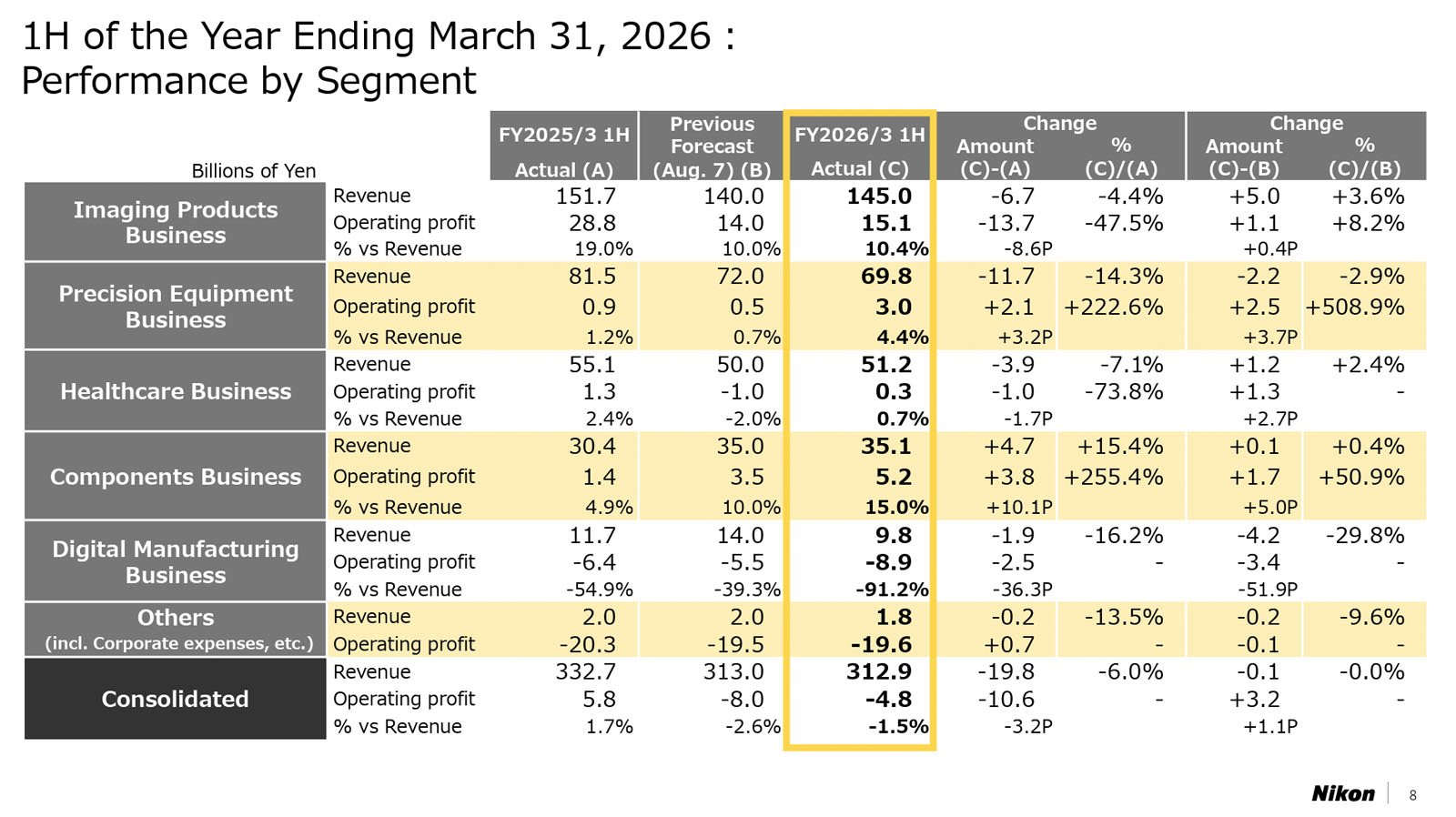

However, Nikon’s losses are primarily due to foreign exchange effects, languishing business segments, and corporate expenses. The company’s imaging division is doing well.

Nikon has had a productive start to FY2026, as the company eclipsed the 50 lens mark for its Nikkor Z interchangeable lens lineup and released its first ever digital cinema camera, the ZR, which incorporates RED technology to great result.

While the overall financial report is mostly negative, there are positive takeaways from Nikon’s latest financial reports. The company expects the second half of this fiscal year to be much better than the first, and still believes it will ultimately finish FY2026 in the black by 14 billion yen ($91.3 million).

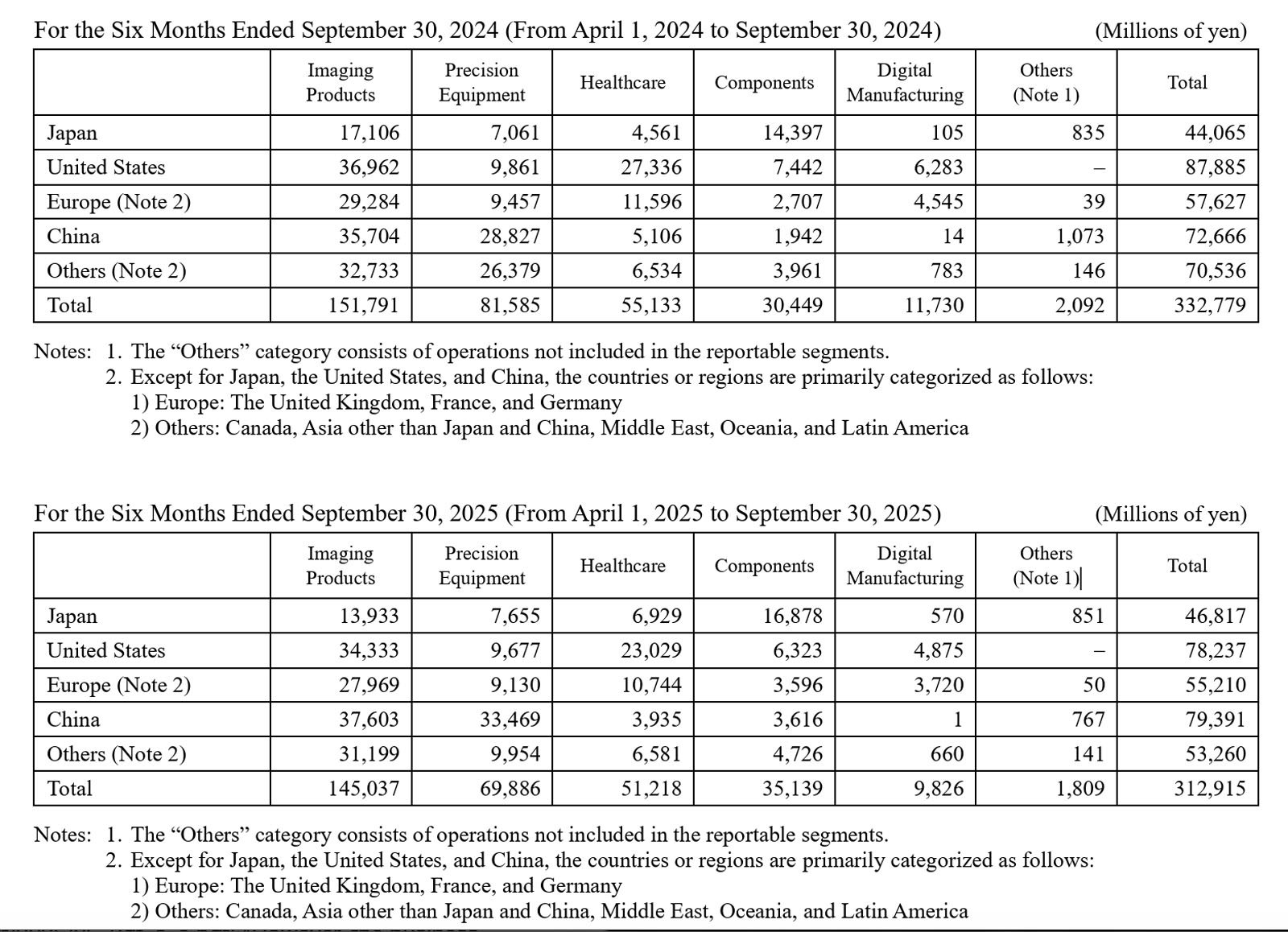

As for its imaging division in particular, it is Nikon’s best-performing division by a significant margin. However, performance was still down compared to last year, even though unit sales increased. Revenue and profits both fell year over year, largely due to lower profit margins on Nikon’s best-selling cameras. Essentially, Nikon’s sales are up, but revenue is down because the company is earning less profit per unit.

“Sales of mirrorless cameras, centered on models such as the Z5 II and Z50 II, as well as interchangeable lenses remained strong, with increases in unit sales,” Nikon explains.

“However, the business segment recorded year-on-year decreases in both revenue and profit due partly to a decline in average selling prices caused by changes in the product mix, as well as to foreign exchange effects and the impact of tariffs. As a result, this business segment recorded revenue of 145,037 million yen (down 4.4% year on year), and operating profit of 15,143 million yen (down 47.5% year on year.”

Nikon’s imaging products segment accounts for nearly half of the company’s overall revenue, so any changes in revenue, and particularly, profit, in the imaging business matter a lot to Nikon’s bottom line.

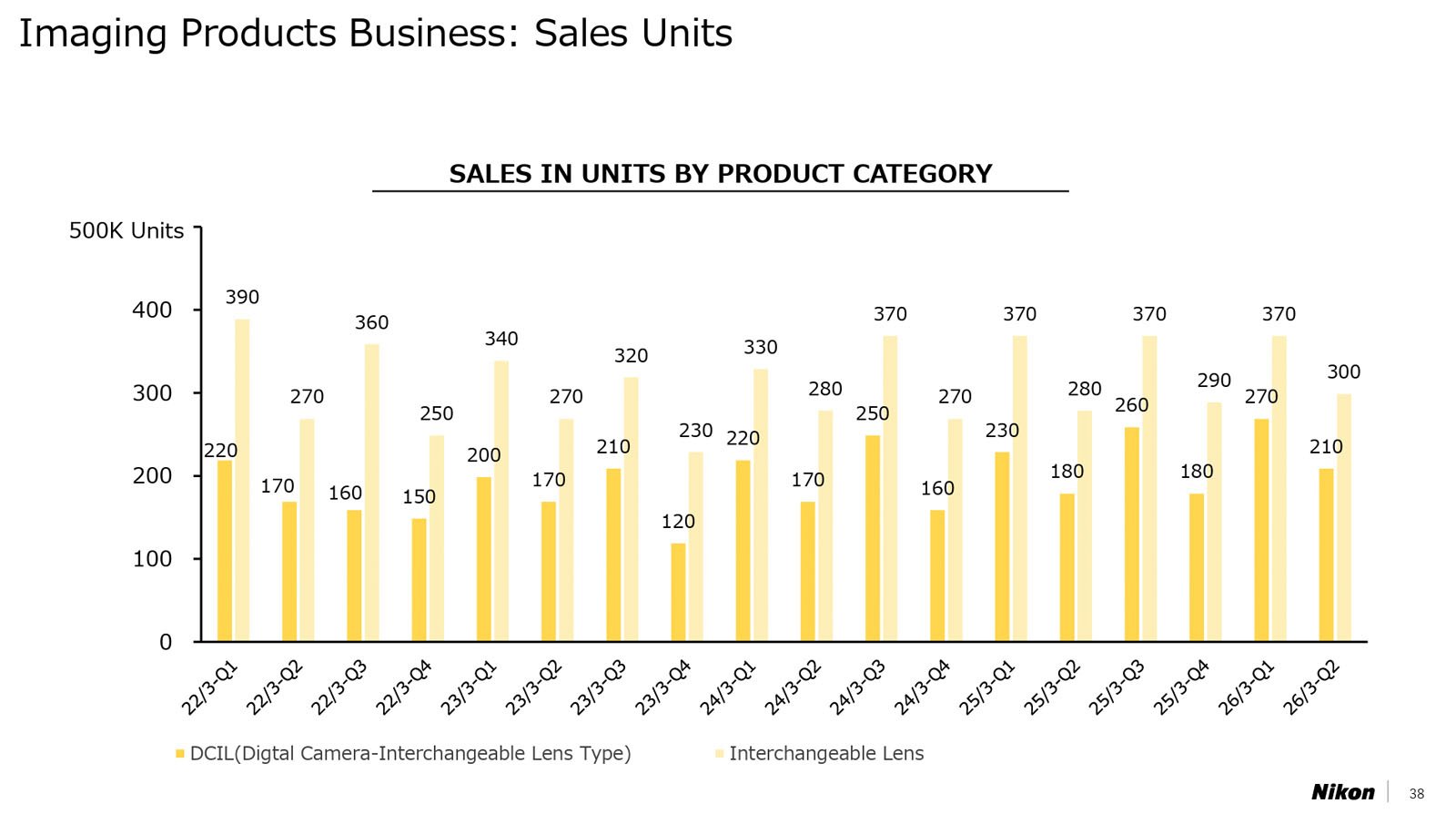

Looking a bit closer at Nikon’s imaging business, the company’s camera and lens sales have been remarkably consistent over the past few years. While FY2026 Q1 was particularly strong, sales of both cameras and lenses dipped in the second quarter. However, Nikon still managed to sell approximately 210,000 cameras and 300,000 lenses, which is better than the same period in FY2022, FY2023, FY2024, and FY2025. Tariffs may be hurting Nikon’s overall business operations, but its imaging division is not particularly feeling the heat.

Image credits: Header photo by Jaron Schneider.