Nikon’s Imaging Division Delivers Strong Financial Performance

![]()

A lot of financial results have been released recently. This time, the company under the microscope is Nikon, who had a solid showing in the first quarter of the fiscal year, continuing the company’s remarkable recovery.

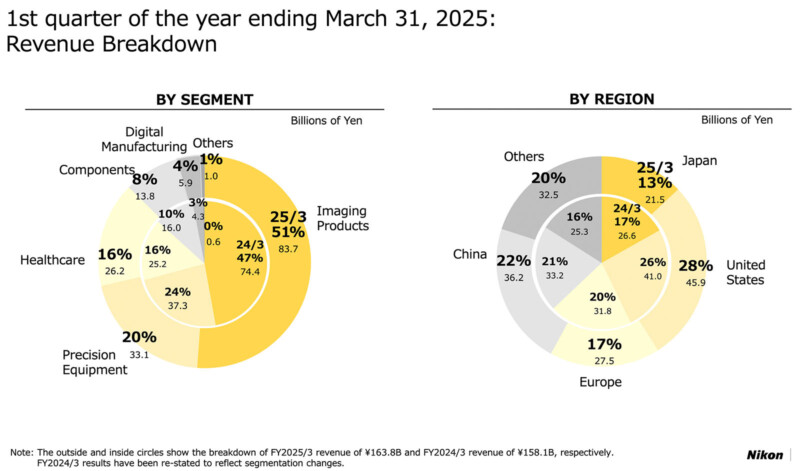

As a company, Nikon Corporation’s revenue was up 3.6% year-over-year to 163 billion yen ($1.1 billion), while operating profit was down 10.3% — but still a healthy 2.95 billion yen ($20 million).

Breaking the data down further, Nikon’s Imaging Products segment, which includes interchangeable lens digital cameras and lenses, saw total revenue increase from 74.4 billion yen ($505.3 million) to 83.7 billion yen ($568.4 million), and profits increase from 15.3 billion yen ($104 million) to 17.8 billion yen (nearly $121 million).

![]()

Nikon also details the number of digital interchangeable lens cameras and lenses it sold in the first quarter of the fiscal year ending March 31, 2025. Nikon says it sold 230,000 cameras, up 10,000 from the prior year over the same period, and 370,000 lenses, a 40,000-unit increase.

![]()

“Revenue and operating profit grew on increased sales of interchangeable lens and [digital cameras] as a result of strong sales of the Z8 and the Zf as well as the launch of the Z6 III,” Nikon explains. “The weaker yen also helped.”

The company also notes that it completed the consolidation of cinema camera manufacturer RED during the fiscal quarter.

The Imaging Products division’s strong performance was slightly undone by quarterly losses in the Precision Equipment, Healthcare, Components, and Digital Manufacturing segments. The Imaging Products segment’s earnings make up more than half of Nikon’s total revenue. The company is also dealing with ongoing “losses” due to investment in growth, which falls under a “reconciliation” segment. Nonetheless, the company’s overall profit before tax for the three months ending June 30, 2024 (April 1 to June 30) is 4.6 billion yen ($31.3 million).

![]()

Returning to imaging, Nikon has revised its forecasts for the rest of the fiscal year, slightly increasing expected revenue and operating profit projections. The company has not changed its projections for total unit sales, however, maintaining the same numbers for camera and lens unit sales.

If the rest of this fiscal year follows patterns of prior years, Nikon should sell fewer products in Q2 before seeing an increase in Q3 and another dip after the holidays in Q4. However, the popularity of the Nikon Z6 III, which technically hit the market after the first quarter ended, may alter that pattern.

Image credits: Financial charts and data courtesy of Nikon.