46% of Tamron’s Sales Come From Making Lenses for Other Companies

![]()

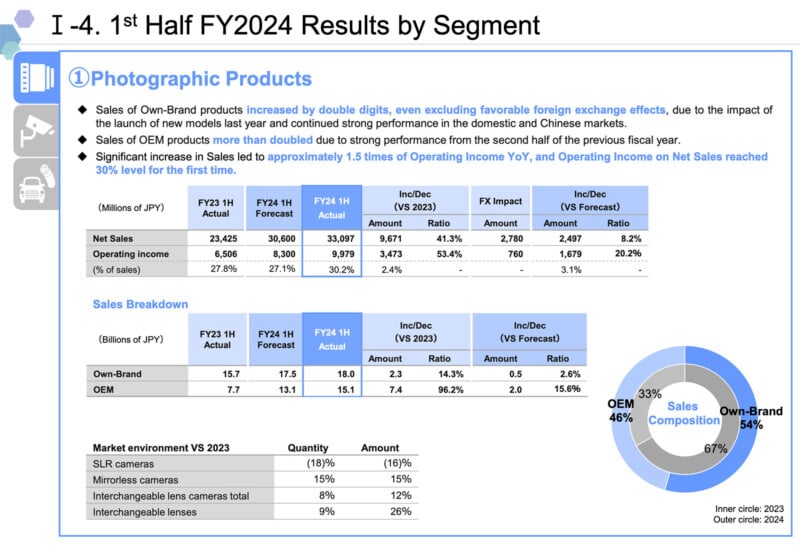

As part of Tamron’s financial reports for the second quarter of this fiscal year, the company breaks down the net sales and operating income of its “photographic products” into “own-brand” and “OEM” products, offering interesting insight into how much money Tamron makes by manufacturing lenses for other companies.

While companies are loathe to say when one of their lenses is made by someone else, there are some clear examples out there, including with Tamron. There are three noteworthy examples in Nikon’s Z lens lineup.

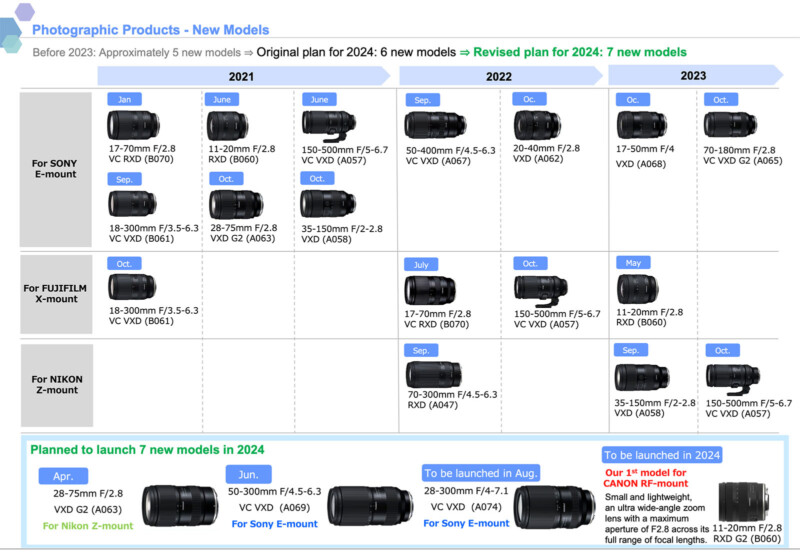

Tamron makes some “own-brand” lenses in Z mount, like the 28-75mm f/2.8 Di III VXD G2, 35-150mm f/2-2.8 Di III VXD, 70-300mm f/4.5-6.3 Di III RXD, and 150-500mm f/5-6.7 Di III VC VXD. However, beyond these Tamron-branded lenses, Nikon’s Nikkor Z 17-28mm f/2.8, 28-75mm f/2.8, and 70-180mm f/2.8 zooms all bear more than a passing resemblance to Tamron’s lenses, including two — the 17-28mm and 70-180mm — that are otherwise available only in E-mount.

Tamron isn’t the only company that makes lenses for other companies. The new OM System 150-600mm f/5-6.3 IS lens, as good as it is, is a rebranded and retooled Sigma 150-600mm full-frame telephoto zoom lens.

There’s nothing wrong with any of this, of course. Tamron and Sigma make great lenses, and OEMs don’t always have the resources to design and produce all-new lenses to fit every niche within their respective camera systems. However, this practice is something of an open secret, and it’s interesting to note that Tamron at least breaks down how its Tamron-branded lens business compares to the money it generates by creating lenses that bear another company’s mark.

In the first half of FY2023, Tamron sold 15.7 billion yen worth of own-brand lenses and 7.7 billion yen of “OEM” lenses, which works out to $107 and $52.5 million, respectively. Over the same period this year, Tamron’s brand sales have increased to 18 billion yen ($122.9 million), while OEM lens sales have skyrocketed to 15.1 billion yen ($103 million). The ratio of own-brand to OEM sales has shifted from about 2:1 to 1.2:1.

“Sales of OEM products more than doubled due to strong performance from the second half of the previous fiscal year,” Tamron explains in its financial presentation. The company also notes that this is the first time the net sales of its photographic products have reached 30% of its overall revenue. Other significant segments for Tamron include surveillance lenses and healthcare products.

Tamron’s financial results also show how lens sales across different camera types have changed year over year. Compared to 2023, DSLR lens sales have decreased nearly 20%, while mirrorless camera lens sales have increased by 15%.

Image credits: Tamron. Featured image created using an asset licensed via Depositphotos.