China Is the World’s Largest Photography Market So Far in 2025

![]()

CIPA recently published its year-to-date photography industry statistics for January through June, showing not only that for the first half of the year, camera and lens shipments are up compared to 2023 and 2024, but also that the Chinese market is playing an increasingly important role in the camera industry.

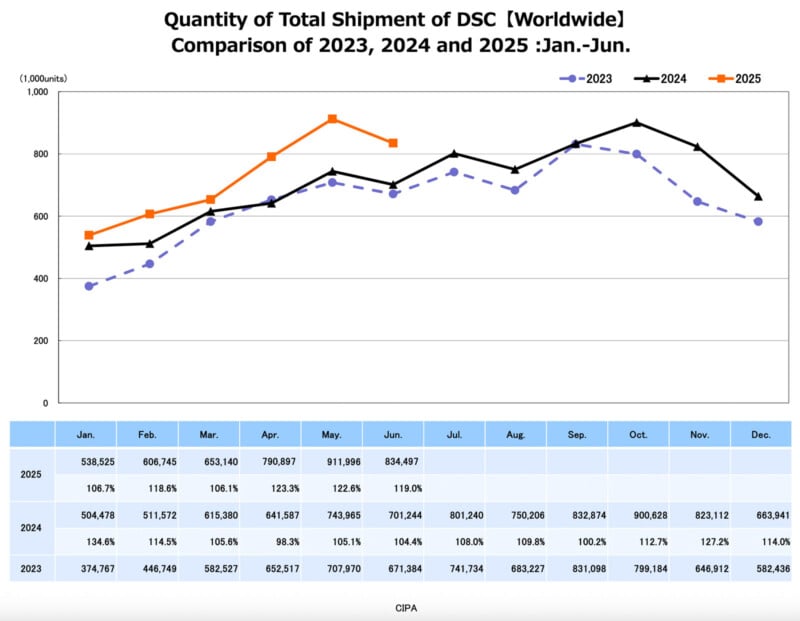

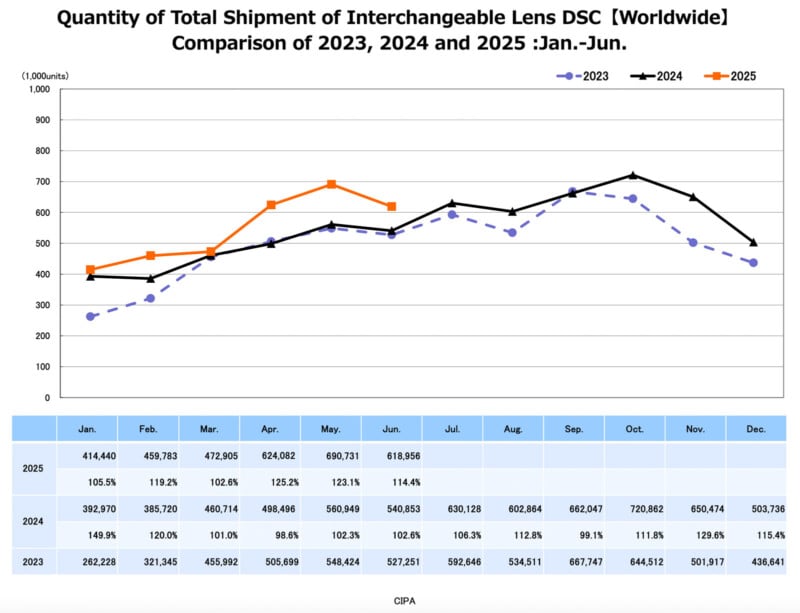

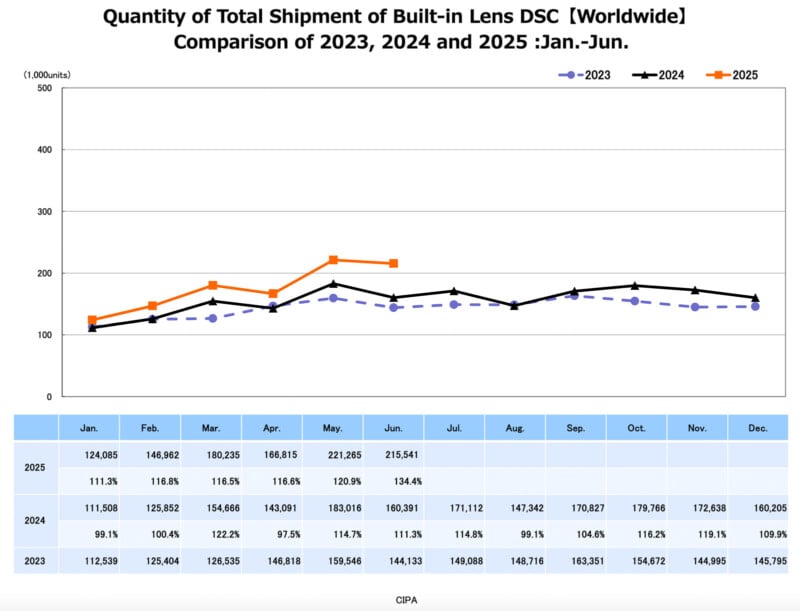

Looking first at the global camera market so far this year, total shipments of both interchangeable lens cameras and lenses with built-in lenses are trending above 2023 and 2024 across the board so far this year.

In the case of interchangeable lens cameras, 2025’s shipments are higher than 2023 and 2024 in every month so far this year. April has been the best month of all, driven by increased demand for cameras ahead of tariffs being implemented in the United States. Camera companies releasing recent financial reports have noted demand spikes in April, May, and June across the board, and this bears out in CIPA’s data. However, the Americas only account for about a quarter of camera shipments, so there could be more to it than that.

In any event, while January, February, and March were all trending higher this year, camera shipments surged noticeably in the following quarter. In May, for example, camera manufacturers shipped 911,996 total digital cameras, 690,731 of which were interchangeable lens models. This is up from 743,965 cameras in May 2024 and 707,970 cameras during the same month in 2023. That said, the largest percentage increase year-over-year was in April, although only barely.

CIPA also tracks lens shipments for interchangeable lens cameras. While it is true that lens shipments are higher in every month so far in 2025, the difference is significantly less noticeable than with digital camera shipments. May has been the best month for lens shipments so far, though, with tracked companies shipping 936,889 lenses.

As Canon Rumors reports, there is also interesting data to consider when it comes to where these shipments are headed.

In 2022, Europe was the largest market for interchangeable lens cameras, accounting for 31% of global shipments tracked by CIPA. That proportion has decreased since, dropping to 27% in 2023, 23% in 2024, and 24.3% this year — a slight uptick year-over-year.

Asia (not counting China and Japan), the Americas, and Japan have all held relatively steady over that same period, shifting year to year by one to three percentage points each.

However, China is a massively shifting market for ILC shipments. After accounting for just 19% of the global market in 2022, China’s significance has increased every year. China’s share of ILC shipments was 24% in 2023, 27.6% in 2024, and is a whopping 30.5% so far in 2025, making it the largest market for ILCs by over five percentage points (the Americas is in second at 25.2%).

Perhaps as interesting as China’s booming interest in interchangeable lens cameras is its relatively little interest in cameras with built-in lenses, including trendy compact cameras. The Americas and Japan are the hottest markets for these cameras, with the Americas having a 26% share of shipments so far this year and Japan at 23%. China, meanwhile, sits just above Asia with a 16% share.

There are a few interesting things to consider here. One, while there has been a demonstrable increase in demand for cameras and lenses so far this year, driven in part by Americans trying to get ahead of expected tariffs, China’s continually growing demand for interchangeable lens cameras is also playing a significant role.

Earlier this year, Nikkei Asia reported that Generation Z in China is growing increasingly dissatisfied with smartphone cameras and jumping to interchangeable lens camera models. The data over the past few years supports this trend, and it shows no signs of slowing down.

It will be interesting to see not only if this trend continues, but also how each camera company responds to growing photography demand in China. Different regions exhibit varying historical preferences, and camera companies must navigate how to cater to each effectively. One thing is for sure: Chinese camera customers are now an extremely important segment of the global market.

Image credits: Header photo licensed via Depositphotos.