Looking into the Future: Whose Camera Will I Buy in 2018?

![]()

I’m not really sure why, but if you want to watch the Fanboys go completely insane, the simplest thing to do it is throw out “your brand is probably going to be out of business in a few years.” But the simple reality is that’s what happens to most companies eventually, especially technology companies. Photography companies, since, oh, about 1850, have basically been technology companies.

The Non-Profit Industry

Reality is reality, no matter how much people want to deny it. Anyone who thinks the camera industry as a whole is thriving needs to up their medication.

There are lots of reasons that explain why the camera industry is weak. Camera phones are taking over for point-and-shoot cameras. Reportage photography is dying, replaced by cell phone pictures and stills clipped from video footage. And on and on. But knowing why only matters if understanding why allows you to adjust. Otherwise, why is just an excuse for the shareholder’s meeting.

![]() Only two camera manufacturers (or camera divisions of big companies) made a profit in 2012: Canon and Nikon. A few, like Sony and Fuji, seemed to be about breaking even. Some, like Olympus, took a beating. Every camera company, including Canon and Nikon, had expanding inventories, which is generally a sign of either weaker than expected sales, or poor management, or both.

Only two camera manufacturers (or camera divisions of big companies) made a profit in 2012: Canon and Nikon. A few, like Sony and Fuji, seemed to be about breaking even. Some, like Olympus, took a beating. Every camera company, including Canon and Nikon, had expanding inventories, which is generally a sign of either weaker than expected sales, or poor management, or both.

Don’t get me wrong, I’m not running around like some people deciding which brands will be gone in 2014. I don’t think that at all. There are other companies in the imaging industry that appear to be doing just fine, however. RED, Black Magic, Sigma, Tamron, and Zeiss all seem to be growing and expanding markets, and those that release financial information are making a nice profit.

But photography isn’t dying — it’s simply changing. When that happens some companies (often the smaller ones) change and survive. Others (often the larger, historically more successful ones) milk their cash cows as long as they can, then close their doors. Brand new companies see opportunities where others see only disaster, come in with fresh ideas, and make a splash. I don’t know which companies are going to do what, but I know that things are going to look different in a few years.

It’s almost impossible to predict how a given company is going to do in a transition period. Take a look (no pun intended) at the audio industry. For 50 years (from roughly 1930 to 1980) if you wanted to listen to music you played a record on a turntable or listened to the radio. New technology, like cassette and 8-track tapes, shook things up a bit in the early 1970s and soon after that CDs and digital audio became the next big thing. During that transition, many of the same companies that had been making radios and record players were still in the game, but the industry was being shaken up.

A lot of people figured out that RCA might struggle to change with the times. (I love this analogy, because it was RCA, way back in 1966, that first stated that the future of audio was in binary digital sound. Sort of like Kodak developed the first digital camera.) Certainly a few people thought that mighty and innovative Sony, with their Walkman tape and CD players, might come to dominate the audio market. If not them, then Phillips, JVC, or one of the other Compact Disc wizardry companies would certainly become dominant.

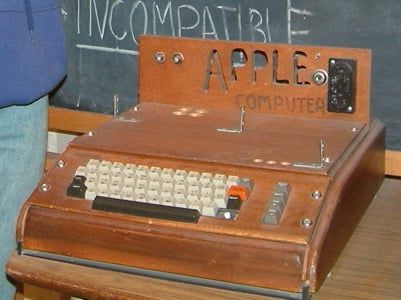

But even the most insane dreamer would never have considered that Apple computer, who in the 1970s was selling this at small trade shows, would be dominating the audio market in 25 years:

Or if you don’t like my audio analogy, take a look at television manufacturers. I like that analogy, too, better because I can clearly remember Sony Trinitron fanboys who knew, absolutely knew, that Sony would always dominate the high-end television market with their Trinitron cathode-ray tube sets. No videophile would ever consider and LCD or plasma set. That was a decade ago, folks, not back in the dark ages. A decade ago nobody would have thought of buying a Vizio television because they didn’t exist.

Going back to the camera industry, I don’t know much, but I do know two things: 1) the companies in the camera industry haven’t really changed much (other than juggling for position) for a really long time, and 2) change is inevitable in every industry.

Who Is Too Big to Fail?

I hear this argument all the time from Fanboys, “my company is too big to fail!!!” Nobody is too big to fail. Ask Kodak or Polaroid.

The Corporations

But I do find it interesting to look at how large the various companies are. First, let’s list the corporations involved in imaging by revenue (numbers are in billions of U. S. dollars). These numbers are from corporate reports, mostly 2012, but I converted yen and won to U. S. dollars using exchange rates from today — some months after the reports were issued. I’m not trying to do an accounting article here, just painting with a broad brush.

![]()

The companies in bold, all-caps in the table above were all quite profitable in 2012. The one in italics (Panasonic) lost significant money. The others either were either near break-even, too confusing to say (Olympus), or private companies that don’t release income (Sigma). Leica recently became a private company, but did release financial results a year ago.

The Imaging Divisions

Since we’re interested in imaging, we really should look at the imaging division revenues for these companies. (For Samsung and Panasonic, I had trouble finding exactly what their imaging revenues are; it’s such a small fraction I couldn’t find it listed separately in the annual reports.) For several of the other companies, Canon, Panasonic, and Sony, imaging includes photo and video equipment, probably plus some other things.

![]()

This looks more like what we usually think of. Canon is the biggest player, with Sony next, followed by Nikon. For those who are used to thinking only of still cameras and lenses, Nikon appears smaller on this list than you’d expect because they’re probably the only pure photography company. Canon, Sony, and Panasonic all include video equipment sales in their imaging divisions. (Be as proud as you like, Nikon fanboys, but video is a growth industry right now and photo isn’t.)

![]() I thought it worthwhile to also list the rough percentage of corporate revenue generated by the company’s imaging divisions. This shows who is “all in”, or at least mostly in, for riding out the ups and downs in the imaging world: Leica, Sigma, Tamron, Nikon, and Canon as corporations will largely go as their imaging divisions go. That doesn’t mean they’ll all remain successful, but it certainly means they’ll at least go down swinging.

I thought it worthwhile to also list the rough percentage of corporate revenue generated by the company’s imaging divisions. This shows who is “all in”, or at least mostly in, for riding out the ups and downs in the imaging world: Leica, Sigma, Tamron, Nikon, and Canon as corporations will largely go as their imaging divisions go. That doesn’t mean they’ll all remain successful, but it certainly means they’ll at least go down swinging.

Even the companies for whom imaging is largely an afterthought still generate a big chunk of revenue from imaging. Plus those companies get a lot of brand-name exposure through their cameras and lenses. Let’s face it, how many of you know whether they used a Zeiss or Leica Operating Microscope when you had surgery? (I know what you’re thinking, and no, Rokinon has not yet released a line of discount surgical microscopes.) My only point is I don’t think these companies would close up their imaging divisions if they had any hope of returning to profitability in the near future.

The bottom line is I don’t think any of the existing companies are going to walk away from the photography business without a fight. Maybe we’ll see a merger or sale, but I don’t expect an outright closure in the next year or two. In five years, though, who knows?

Random Thoughts

One thing I found interesting was the total revenue of the imaging industry. Obviously there are companies I don’t have listed, like RED, JVC, Phase One, etc), but I think the $38 billion total from the table above probably represents 80% or more of all the revenue generated in imaging devices. Just to be generous, let’s say the worldwide imaging market is $50 billion. That helps me understand why Samsung ($247 billion in revenue) or Apple ($156 billion in revenue) don’t seem to think photography is the key to corporate riches and world domination.

![]()

Think about it. Samsung’s net income in 2012 was 18 billion dollars. That’s probably more than the total profit of all the imaging businesses in the world. If Samsung thought imaging was such a great place to be, they’d just buy up a few of the other companies on the list. Then again, Samsung probably doesn’t even realize they’re in the imaging business at all. (If you go their camera website, you won’t have any trouble believing Samsung doesn’t know they have an imaging division.)

The Existing Camera Companies

![]() Obviously the Micro 4/3 manufacturers are having financial problems, but their products are excellent. If the industry as a whole was stronger I’d think they might be acquired. But I think Panasonic’s overall problems would limit their interest in picking up Olympus’ cameras and Sony has made it pretty clear they’re investing in Olympus’ medical equipment division, not consumer imaging. I wonder if this is the reason Zeiss, which is a member of the 4/3 consortium, decided to develop lenses for Fuji and NEX cameras, but not Micro 4/3. They know a lot more about the camera business than I do.

Obviously the Micro 4/3 manufacturers are having financial problems, but their products are excellent. If the industry as a whole was stronger I’d think they might be acquired. But I think Panasonic’s overall problems would limit their interest in picking up Olympus’ cameras and Sony has made it pretty clear they’re investing in Olympus’ medical equipment division, not consumer imaging. I wonder if this is the reason Zeiss, which is a member of the 4/3 consortium, decided to develop lenses for Fuji and NEX cameras, but not Micro 4/3. They know a lot more about the camera business than I do.

Still, I don’t expect Micro 4/3 to vanish in the next couple of years, but I think it might by 2018. Five years is a long time in the camera industry, two to three generations of technology. I should be clear that my misgivings don’t mean I’d have any hesitation to buy a Micro 4/3 system today. Chances are absolutely zero that I’ll be shooting the same camera in five years no matter what brand I choose, so if I’m buying today I’ll buy whatever system best meets my needs today.

Fuji and Sony seem to be aggressively innovating and pursuing the imaging market so I don’t expect they’re going anywhere. Both also have extensive patent portfolios in sensors so they’re almost doubly invested in succeeding. Ricoh just recently bought Pentax so it certainly seems their intention is to make a go of things. Will they all be making photography cameras in 2018? I don’t know, but I’d give them a ‘probably’ rating.

Nikon and Canon certainly will be around in 5 years. Canon appears to be very aggressively pursuing growth in the video segment and maintaining their photography business. It seems Nikon is concentrating on trying to take market share in the photography arena. I don’t see any reason either company will change their direction much in the near future.

Inside Outsiders?

Have you noticed the bigger changes in the imaging arena are not originating from the big companies? Like dominant companies in other industries, the first thought at dominant camera manufacturers seems to be “don’t do anything to hurt the cash cows.”

![]() But smaller companies are shaking things up a bit. Sigma and Tamron are both releasing very high-quality lenses and competing at the upper end of the market place, not just in consumer and crop-sensor zooms where they’ve lived for years. Samyang (a company smaller than any on my list above) is releasing cost-effective lenses with good image quality almost every other month. Zeiss has started releasing autofocus lenses (contrast detection AF, to be sure, but still a big step). SLR Magic has a line of quirky, but very wide aperture, low-cost lenses.

But smaller companies are shaking things up a bit. Sigma and Tamron are both releasing very high-quality lenses and competing at the upper end of the market place, not just in consumer and crop-sensor zooms where they’ve lived for years. Samyang (a company smaller than any on my list above) is releasing cost-effective lenses with good image quality almost every other month. Zeiss has started releasing autofocus lenses (contrast detection AF, to be sure, but still a big step). SLR Magic has a line of quirky, but very wide aperture, low-cost lenses.

Sigma is releasing interesting cameras and while they have flaws, the flaws are largely in camera electronics and signal processing, the kind of thing an outside company could easily rectify for them. Having high optical quality lenses in their lineup could have a nice positive feedback loop with camera sales.

At least some of the larger companies have gone to, shall we say, ‘cost effective’ customer support and repair policies in the last few years. Smaller companies seem to be heading the other way. Tamron is guaranteeing a 3-day turnaround on repairs or they’ll offer a refurbished lens as a replacement. Sigma has revamped quality control and their repair service, and has just released a dock to allow you to adjust autofocus on some of their lenses far more completely than camera microfocus adjustment can.

I don’t think I’ll be buying a Tamron camera in 5 years, you never know. In another two or three generations Sigma camera might be quite attractive. Or maybe Zeiss will be offering a camera. Probably not, I agree, but I do think the odds of me putting a third-party lens on whatever camera I do buy are going to be pretty significant.

Outsiders Coming In?

So, back to the original question — whose camera will I buy in 2018? I think what will happen over the next few years is very similar to what happened to the video camera market over the last 7 or 8 years. In 2004, Sony, JVC, Canon and Panasonic dominated the ‘pro’ and ‘prosumer’ video markets. Cameras with three separate 1/2″ CCD sensors were dominant in the digital realm. A lot of videographers still recorded to tape and then digitized in editing.

![]() Shooting full-frame video on an SLR wasn’t even a consideration and camcorders with large, single CMOS sensors were unheard of. RED camera was only a rich man’s idea and hadn’t even made it to the garage stage. Black Magic was a little company that made capture cards. The camcorder industry is amazingly different now. Companies that didn’t exist then are kicking some serious butt today. Some of the older companies are doing very well, although with very different technologies. Others are fading fast, although they’re still in the business.

Shooting full-frame video on an SLR wasn’t even a consideration and camcorders with large, single CMOS sensors were unheard of. RED camera was only a rich man’s idea and hadn’t even made it to the garage stage. Black Magic was a little company that made capture cards. The camcorder industry is amazingly different now. Companies that didn’t exist then are kicking some serious butt today. Some of the older companies are doing very well, although with very different technologies. Others are fading fast, although they’re still in the business.

So I really think there’s an excellent chance that the camera brand I buy in 2018 may be a brand that doesn’t make cameras today. I know that making an SLR is more complex than making a video camera. Things must be placed in a much smaller package and phase detection autofocus alone is an extremely complex technology.

But those difficulties aren’t insurmountable. A lot of companies have those technologies, and those in trouble may be very willing to sell them. Sony, Fuji, and lots of other companies sell excellent imaging sensors. Companies like Imaging Solutions Group happily design camera electronics and arrange manufacturing. Companies like Ishikawa Koki design and assemble lenses. Of course, there are dozens of companies that will assemble cameras and lenses for anyone who has the capital.

Why would someone want to get into what appears to be a stagnant business? Because they’ll believe they can do things differently, making cameras that are more cost effective, or more attractive, than what’s available now.

Perhaps it will be a specialty camera, like a medium format, 80 megapixel, live-view focus only, landscape body with ultra-high resolution for the cost of an SLR. They might offer an optional bellows attachment, or interchangeable lens mounts. A niche market, for sure, but I know some people who would love one. Especially if they could shoot their Nikon 14-24 f/2.8, then swap around to a Canon 300 f/2.8, and finally clip on a bellows and classic Hasselblad medium format lens.

![]() Maybe it will be a modular camera that allows you to pick your sensor, viewfinder, storage media, flash attachments, LCD, etc. You buy only the modules you need and change them out as conditions warrant. As I mentioned earlier, I’d love to an interchangeable lens mount. Sigma makes autofocus lenses for 6 different autofocus systems. I bet somebody could make a camera with translation chips that can autofocus 6 different lenses.

Maybe it will be a modular camera that allows you to pick your sensor, viewfinder, storage media, flash attachments, LCD, etc. You buy only the modules you need and change them out as conditions warrant. As I mentioned earlier, I’d love to an interchangeable lens mount. Sigma makes autofocus lenses for 6 different autofocus systems. I bet somebody could make a camera with translation chips that can autofocus 6 different lenses.

History would predict, though, that the new camera features of 2018 won’t be anything I will think of, but rather something I haven’t considered at all. But given the overall state of the camera market today, and the number of ‘anonymous’ corporate-survey-companies that have asked me to participate in think-tanks lately, I do believe in a few years I’ll at least be considering a brand that doesn’t even exist today.

These are certainly interesting times for the camera industry. “May you live in interesting times”, is supposedly (but probably not) a Mandarin curse. Large corporations (and their strident fanboys) probably do consider it a curse. Consumers like me think interesting times are blessing.

About the author: Roger Cicala is the founder of LensRentals. This article was originally published here.

Image credits: Photo illustration based on Fortune Teller by A.Davey, Seattle Transit System 32 Year Net Loss & Profit History by Oran Viriyincy, Stacks by RLHyde