The State of Film’s Comeback in Japan (and What’s Holding It Back)

The entire world has felt film photography’s resurgence, and Japan is no exception. Home to a majority of the major photography brands, the country has re‑embraced analog photography but not without growing pains.

To put hard numbers behind the anecdotes, Kimiyasu Morikawa surveyed 802 Japanese shooters online at the end of the year 2024. The data expose what drives today’s film fans, what holds them back, and where new opportunity lies. Below are some highlights but the full report can be downloaded here.

Who took the survey?

- Experience: While 31% have shot film for over 10 years, 34% were newcomers of five years or less.

- Age: The core audience was in their 20s to 30s (51 %), yet every decade—from teens to seventies—shows were represented.

- Region: 56% live in the greater Tokyo–Kanto area, mirroring both Japan’s population density and its film photography ecosystem concentration, including labs, retail stores, and events.

Typical Photographers Go Through a Roll Every Month

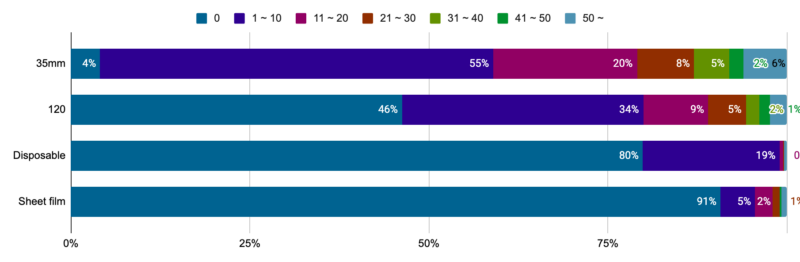

On average, Japanese users ran through 13.7 rolls of 35mm film in 2024. Half of the respondents also shot 120 medium format films, averaging 6.9 rolls in a year. Sheet‑film users remain a minority at under 10%. Heavy users who shoot more than 50 rolls of 35mm per year make up 6% of respondents.

Compared to a recent similar research performed by Ilford, Japanese film photographers have less tendency to shoot with 120, sheet film, or other less-commonly used film types. This could come from the fact that fewer and fewer Japanese film labs are supporting film formats other than 35mm.

Why Are Japanese Photographers Shooting Film?

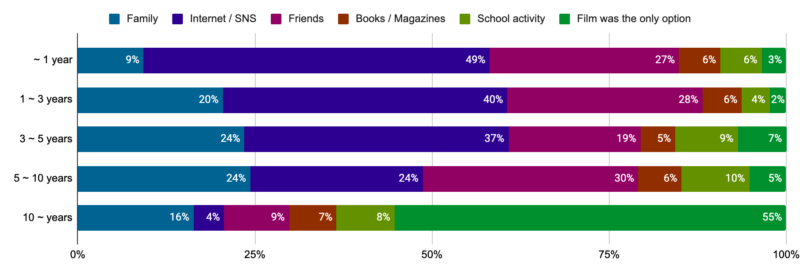

Different characteristics were observed depending on the years of experience. Among those who started film photography within the past five years, “Internet/SNS” accounted for the largest percentage as a motivation. “SNS” is a term used in Japan to describe social networks and stands for “social networking sites.”

As the years of experience increased, the proportion of respondents who were motivated by “family” increased, with approximately one in four of those in the three to 10 years experience group having started film photography because of family influence. On the other hand, this trend did not apply to those who have been film photographers for more than 10 years, with the most common response being that “film was the only option”.

Cost is a Huge Factor in the Low Number of Rolls Shot Per Year

Thirty percent said they shot more film in 2024 than in 2023, versus 27% who shot less. The main accelerator was “buying a new camera,” with many respondents mentioning the Pentax 17, which was introduced in 2024. The availability of new film gear is a strong catalyst for film stock demand.

On the other hand, cost is the overwhelming factor for why growth isn’t more substantial. 70% of those who used less film complained about the price hikes for film purchases, development, and scanning.

Film Is More Expensive In Japan, Even From Local Manufacturers

Price complaints aren’t abstract. A single roll of Fujifilm 400 sells for ¥2,200 (about $15) on Amazon Japan as of May 2025. The identical roll lists for little over $8 at B&H Photo, which is roughly half the price.

Some Japanese enthusiasts now “import” film from US retailers like B&H to save money, a bitter irony given that Fujifilm is a Japanese brand. Rising silver prices (up about six times since 2000, according to Japanese trading companies) and limited domestic lab capacity compound the squeeze.

Fujifilm 400 is considered an affordable film as well — this problem doesn’t even refer to the exorbitantly high price of Fujifilm Provia 100F or Velvia 50/100. Fujifilm recently raised its film prices again by between 21% and 52%.

Demand Is There, Supply Is Not

Film shooters in Japan fall neither into what can be described as the nostalgic fringe nor are they being driven by short‑lived TikTok fads. They are a diverse, motivated community balancing fascination and frustration — they are eager to pay for quality, but unwilling to be priced out of their own country’s film. If film manufacturers like Fujifilm solve the cost problem while feeding the hunger for fresh gear, they will find an audience ready to load far more than 13.7 rolls next year.

About the Author: Kimiyasu (Kimi) Morikawa is a New York–based technologist and film-photography enthusiast. After his most recent role at Boston Consulting Group, he is completing an M.S. in Computer Science at Georgia Tech. Passionate about both digital processes and analog darkrooms, Kimi’s recent survey on Japan’s film-photography revival was featured in multiple Japanese media outlets.