Will Skyrocketing Silver Prices Make Photo Film Even More Expensive?

![]()

After hitting a record high of over $82 per ounce over the past few days, analog photographers may have cause to worry about the price of their film. Silver is an essential component of film production, and silver prices have more than doubled in 2025.

While silver trading prices dipped back below $80 after trading opened this morning, the recent surge pushed silver prices above the $80 per ounce threshold for the first time amid a broader rise in the value of precious metals this year.

The photography industry has a long history with silver, as silver halide is the light-sensitive material in photographic film. As Lomography puts it, “A photograph is the final result that occurs when a chemical reaction exists between light and sensitive silver grain compounds.”

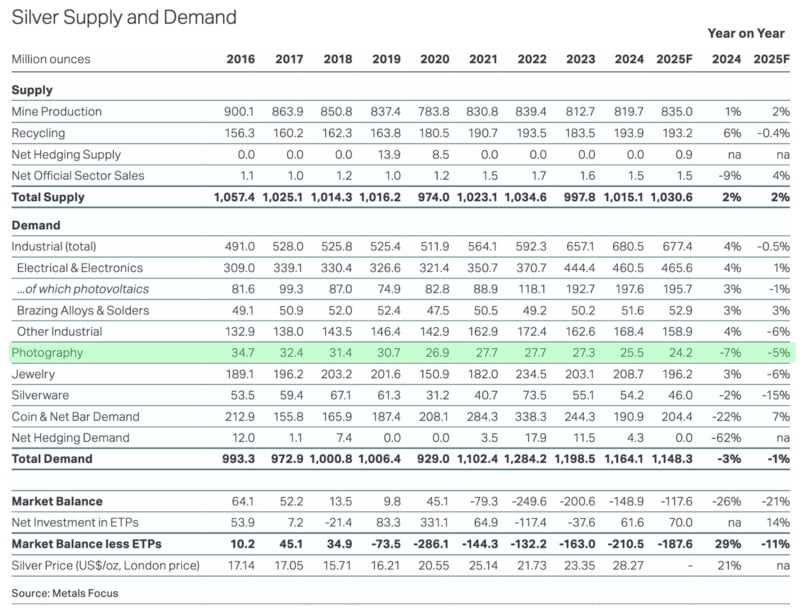

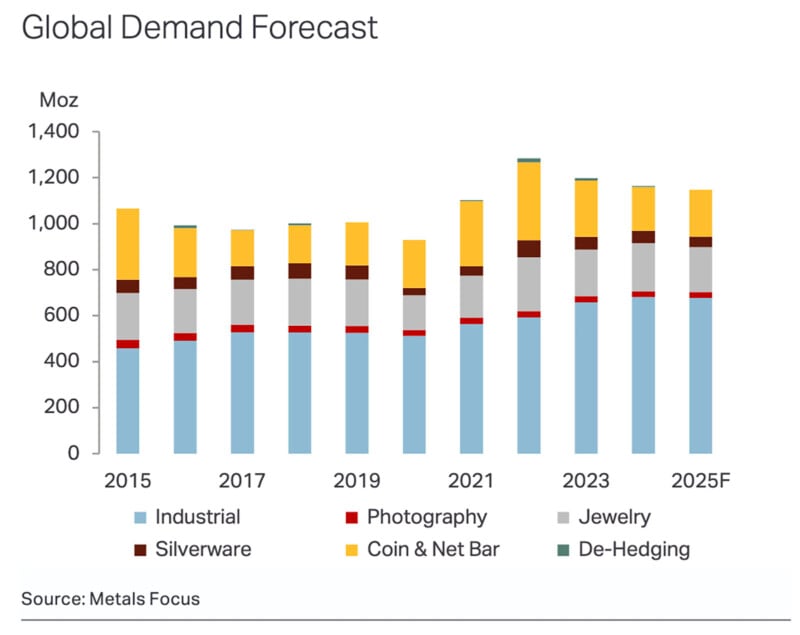

Given the essential nature of silver in film production, it is of little surprise that film manufacturers are major players in the silver market. Per the World Silver Survey 2025, produced by The Silver Institute and Metals Focus, the photography market demanded about 25.5 million ounces of silver last year and is projected to account for 24.2 million ounces this year.

There are two things to consider as silver’s price skyrockets. The first is how silver’s rising price might affect the cost of new film production, as an increase in material costs almost inevitably increases the final product’s cost; and secondly, just how much new film is actually being made.

This second question is fascinating because analog photography has experienced a notable resurgence in recent years, yet demand for silver in the photography market has decreased nearly every year.

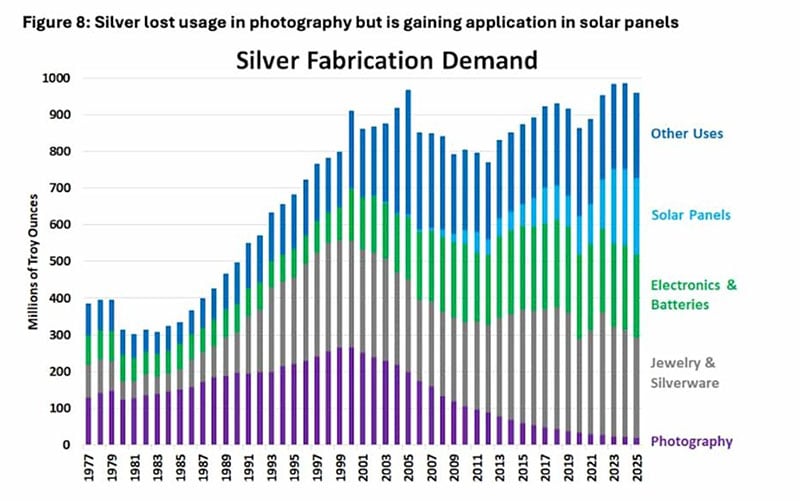

This nearly-constant dip in demand is echoed by data from the CPM Silver Yearbook 2025, which shows overall silver fabrication demand by industry from 1977 through 2025.

In the chart above, there is a fairly consistent, albeit slow, trend of growing silver demand overall. The photo industry’s demand for silver peaked in the mid- to late 1990s and has decreased nearly every year since, including during the ongoing analog photography renaissance. Photography once accounted for a massive chunk of global silver demand, but is now just a mere fraction, trailing far behind electronics industries, jewelry, and solar panels, which are now a big part of the global silver trade.

The historical importance of photography for the silver market is also evident during the period from 1999 to 2005. As photography’s demand for silver dropped, other industries had to pick up the growing slack. The digital photography revolution is evident not only in photography’s share of the graph but also in the global silver market. Film photography was once crucial for silver mining and refinement operations.

As the charts show, even as analog photography has become more popular again, it has not become so popular that it is moving the needle much in terms of the photo industry’s demand for silver. Increasing demand for film has significantly slowed the bleeding, and the photo industry’s demand even increased slightly a few years ago, but it has not come close at all to rebounding in a big way. With that said, since photography is lumped together as one big pool in the data, it is also possible that traditional photography’s demand for film has increased while demand for specialized types of photographic film, like X-ray film, has decreased, leading to a slight overall decline.

Nonetheless, a lot of new film is still manufactured every year, and silver’s price fluctuations impact production costs when new silver must be purchased.

Even though silver prices dipped 6% after trading opened today, they are still up nearly 140% so far in 2025 and show no signs of reverting all the way to the roughly $30/ounce prices silver started the year at. For legendary, longstanding photo companies like Eastman Kodak, there is no doubt that rising silver prices have been noticeable on balance sheets or will be very shortly. The situation is perhaps even more relevant for smaller, newer operations, like China Lucky Film, which is making a brand-new 35mm film right now.

Hopefully, for the sake of analog photographers everywhere, rising silver prices will not dramatically increase the cost of new film. Film photography is already a pricey way to take photos; it would be a shame if the cost rose even higher, right as film photography is embracing its second life.

It would be especially unfortunate if film prices skyrocketed in turn with silver prices, because the rising price appears to be driven primarily by speculation, likely surrounding the use of silver in solar panels, a growing energy market. As the data above shows, global demand for silver has not doubled. In fact, it has not increased at all this year. Demand is outpacing supply, but that has been true since 2021, and silver prices remained remarkably steady over that period until the second half of 2025.

“Make no mistake: we are witnessing a generational bubble playing out in silver,” says Tony Sycamore, a market analyst for IG Australia.

Image credits: Header image created using an asset licensed via Depositphotos and an image from Kodak.