Analog Camera Apps Aren’t the Surefire Bets Investors Think They Are

Lapse is the latest analog camera app to see a great deal in funding, but it's rarely a bet worth placing.

Lapse is the latest analog camera app to see a great deal in funding, but it's rarely a bet worth placing.

AI-powered photo editor Photoroom has received a significant injection of new funding to the tune of $43 million.

Fujifilm is investing 4.5 billion yen (about $30 million) into its Ashigara Site at the Kanagawa Factory in Japan in order to boost its Instax film production capacity by 20%.

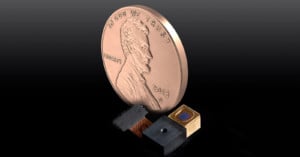

Metalenz, which makes flat, “meta-optic” lenses for 3D imaging and sensing – like those used in facial recognition – that are incredibly compact and multifunctional, just closed a $30 million venture funding Series B round and is shipping product to some “household names” in the mobile device game.

The Giant Magellan Telescope, the most powerful telescope ever engineered, has secured a new $205M funding infusion that will be used to accelerate its construction. When finished, it will be four times more powerful than the James Webb Space Telescope.

Panasonic will release a mirrorless camera that it will jointly develop with Leica "in about a year" that is the result of the expanded partnership the two brands signed in May.

Panasonic and Leica have announced a new agreement for a comprehensive business alliance and work even more closely together to develop new technologies under the name L2 Technology (L squared Technology).

Commercial photography is as saturated a marketplace as any these days. With such stiff competition, it’s no wonder brands are raising the bar on those of us trying to break our way into the industry. No experience? No thanks.

The used camera market is booming if a recent cash investment of £49.8 million (~$69 million) that MPB.com just raised is any indication. The company claims to "recirculate" about 300,000 pieces of equipment a year and expects to pass $139 million in revenue in 2021.

Nikon has bought a majority stake in the U.S. startup Morf3D, an aerospace supplier that has a list of high-profile customers internationally including Boeing. The Japanese camera company's investment comes ahead of an expected boom in small satellite production.

Snappr wants to be the go-to service for business to get fast, easy access to photographers at rates as low as $89 per session. The company operates like a mix of Uber and ThumbTack, with on-demand access to creatives in 200 metropolitan areas, and could be coming to a city near you.

The American billionaire Koch brothers now own a sizable chunk of Getty Images after the investment arm of Koch Industries agreed to make a $500 million investment in the stock photo agency.

Light, the startup behind the groundbreaking 16-camera camera L16, has a new investor with a much longer history in photography. Leica is now a shareholder in the computational photography company.

Magnum Photos, one of the most prestigious photographic agencies in the world, is celebrating a storied 70-year history this year, but it is a history that has not been without financial trouble. The agency has recently announced that they will be taking outside investment for the first time to help them grow and innovate in the digital age.

Since being founded in 2012, Gameface Media has become a dominant force in amateur sports event photography. But in recent times, photographers shooting for Gameface have complained of payments being delayed by many months. Today there's a bit of good news: Gameface has raised another $2.6 million from investors and is now promising to pay photographers very soon.

About a year and half ago, after what seemed like a lifetime of living paycheck-to-paycheck (paying off student loans and other debts) my wife and I were sitting in the office of a financial advisor with money to invest. After hearing the options to best set us up for retirement, he asked, “What are your goals?”

What's the best deal you've ever gotten in a photo gear trade? Whatever it is, it's probably not better than British photographer John Swannell's best trade. He managed to turn a cheap thrift store camera bag into about $42,000.

When Light unveiled its revolutionary L16 multi-aperture computational camera in October 2015, people were so excited by the device that the company blew past its first month sales goal in the first two days. Today the company announced that it has just raised $30 million in funding to change the way people take pictures.

The drone company XCraft has successfully raised $1.5 million at a $6 million valuation after appearing on the ABC reality TV show Shark Tank. The two founders convinced all 5 "sharks" to invest in the company, which builds next generation camera drones that go beyond your standard quadcopter.

500px today announced that it raised another $13 million in venture funding in order to continue growing its photo sharing and licensing services. The fresh cash will help the company battle against bigger companies in both spaces, including Flickr and Getty Images.

The world's largest drone maker is quickly becoming one of China's most powerful homegrown companies. DJI announced today that it has raised another $75 million in venture capital funding, and recent talks with investors have reportedly pegged the value of the company at a whopping $10 billion.

Visual Supply Co., better known as VSCO, is becoming a juggernaut in the photo world. After raising an impressive $40 million from investors last May in order to build out its photo community, the Oakland-based retro preset company has just raised another $30 million.

Photo sharing service EyeEm has raised an additional $18 million in funding after taking $6 million from investors back in 2013. The new war chest will be used to further the company's mission of becoming the top network for photographers looking to make some money with their photos.

Lytro has announced that it just raised $50 million to undergo a "strategic shift" in strategy. Instead of focusing on light field photography and refocusable 3D photos, the company plans to expand into the fields of video and virtual reality. A large number of jobs will be shed during this process.

Here's some news that flew under our radar late last year: in December 2014, a family in Minnesota became the majority owner of Polaroid through a $70 million deal.

Known most for their film emulation presets, mobile app, and creative network, Visual Supply Co. has taken the photography world by storm since their inception in March of 2011. Releasing VSCO Film, VSCO Keys, VSCO Cam, VSCO Grid, and their VSCO Journal, they’ve shown that they aren’t only a company looking to sell products – they’re a company striving to build an entire community by creating and establishing effective resources for photographers.

And as of today, there’s proof in the form of dollars that others believe in their endeavors. $40 million dollars worth of belief to be precise.

The use of social media has become vital for the news-reporting agencies and outlets of the world. Mix that in with the ubiquity of mobile phones, and it means there are cameras virtually everywhere, and organizations like the Associated Press know this.

Lytro is seeing more and more competition these days, as more and more companies are jumping into the "snap now, focus later" game. There are now apps that mimic the technology, and companies like Toshiba are working on building Lytro-style smartphone camera modules.

Lytro's latest challenger may be quite a formidable foe: it appears that Nokia has invested in Pelican Imaging, another startup that's working on building Lytro-style smartphone camera arrays.

'Tis the season of mergers, acquisitions, and investments. At around the same time Adobe announced its acquisition of Behance yesterday, Taiwanese gadget manufacturer Foxconn (officially known as Hon Hai Precision) announced that it has snatched up 8.88% of GoPro for $200 million. The deal values the California-based action-camera maker at a whopping $2.25 billion.

People say money can't buy happiness. Turns out there's another thing it can't buy: photo sharers. Despite raising a staggering $41 million in funding before even launching, the photo sharing app Color has been struggling to find users. Even after major pivots that changed the service's DNA, the app only has less than half a million active users.

There was a good deal of buzz in the tech world today after Ricardo Bilton of VentureBeat reported that the app has been slated for closure.

Sony has agreed to pour $645 million into Olympus in exchange for 11.5 percent of the embattled company, becoming the single largest shareholder. While the companies announced that they are considering cooperating in the digital camera industry, the main motivation for Sony wasn't photographic imaging but body imaging. Olympus is one of the major players in the medical endoscope market, holding about 70% of sales, and Sony's investment allows it to dip its toes into this lucrative industry.

Bankruptcy has not been friendly to Kodak. The once-important camera company — now a printing company — is worth …

As Olympus attempts to regain its footing after the devastating financial scandal that rocked it this past …

Photo agency Getty Images is on the auction block, in a second round of bids that are climbing towards $4 billion for a potential sale. Investment firm KKR & Co. and private equity investment firm TPG are on the list of at least five interested bidders, the Wall Street Journal reports.

Ever since their financial scandal, Olympus has been looking to bring on a big name investor to help get them out of trouble. Earlier this month that investor seemed to be Panasonic, but when that fell through everybody looked to the remaining three possible investors -- Sony, Fujifilm and Terumo -- to see if anybody was going to make the leap. According to Japanese business daily Nikkei, that investor is Sony.

Due in large part to the massive accounting scandal that Olympus found itself in at the end …

Instagram is set to raise a massive Series B round of venture financing and, …

Crippled by its recent financial scandal, Olympus is in need of a bailout and has been open …

Reuters is reporting that US-based investment firm …

The mobile photo sharing space is hot right now, with services like Instagram, Picplz, and Path growing like weeds. A new contender called Color is causing some buzz after successfully raising a whopping $41 million... before even launching. The company has seven notable founders who have either started successful companies in the past (e.g. Lala and BillShrink) or have held executive positions at them (LinkedIn). Among the investors is Sequoia Capital, one of the most influential and successful firms in Silicon Valley and the firm that funded Google. They gave Color more than they gave Google.